By Caldwell Hart

A recent McKinsey report ranked an “increase in supply chain disruptions” a low impact trend amongst CEOs in 2023 heading into 2024. However, “Escalation of Geo-Political Risks” and “Risk of prolonged high inflation and an economic downturn” ranked highest. Unfortunately, this report highlights a continued short-term focus and a sense of complacency retaking industry. Within the last two weeks, geo events, such as the Houthi rebel attacks on shipping in the Red Sea have once again exposed a potential risk and disruption to a vital trade route.

While this is not significantly directly impacting US trade, the news from Maersk, MSC, and Hapag Lloyd has T&L teams serving European and Asian operations revaluating this route. Rerouting can add as much as 10 days to the trip and $1M in fuel costs. According to New Dominion Consulting Partner Sal Gausto, “Rates in the region have increased by $3,000 per container in the past three weeks despite new contracts going into effect in October. This is higher rate for this route than during Covid.” There is also a significant, negative sustainability impact, this route adjustment increases the GHG emissions for the voyage.

As the Covid shutdown and the incessant disruptions of 2021-2022 fade into history, a false sense of calm and an uncomfortable feeling of déjà vu is descending on supply chains around the world. This region has seen Somali Pirates and other attacks or disruptions to shipping for decades.

Is this a situation that companies should take in stride and work to manage around?

As inflation remains a concern, conflict dominates the news, and climate issues continue, many seem to be growing immune to the constant barrage and accepting an increased risk of disruption as part of the “new normal”. Complacency and acceptance of disruption contributes to what seems like an endless cycle of crisis management and tactical maneuvering.

Let’s break this cycle by learning, testing, adapting, and redesigning supply chains.

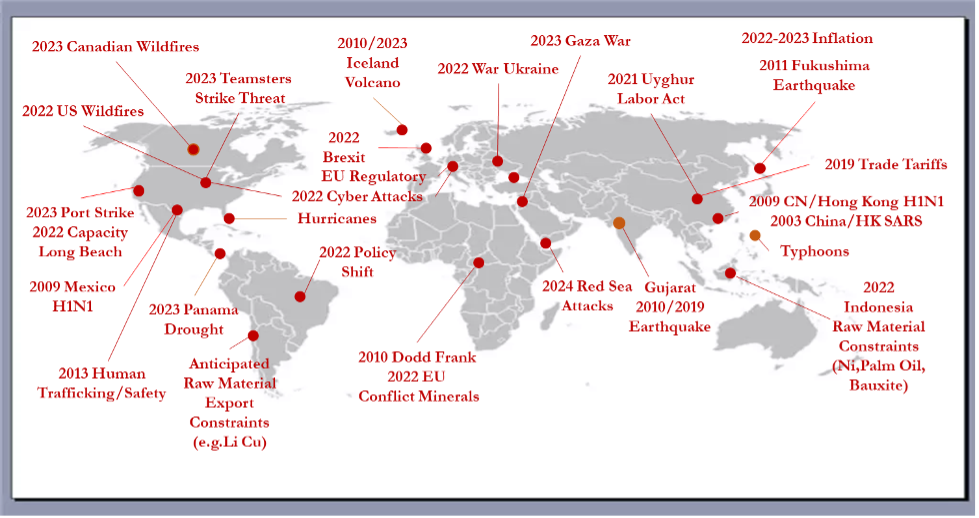

History has shown that supply chain disruptions can often be the result of geo-political risk, economic risk, climate risk, and or a combination of many factors. As the disruption map below demonstrates, the list of factors impacting companies supply chains and operations over the past decade is complex, overlapping, and frequent. These are never singular events that begin and end on schedule with predictable impacts.

In June 2022, McKinsey and the World Economic Forum published an article that contained research demonstrating that companies who prepared, developed strategies and plans, and executed well rebounded from major events such as the great recession and the Covid shutdown better, stronger, and faster than their peers. Of 1500 companies surveyed in the McKinsey article, approximately 20% took these actions to boost resilience, such actions enabled them to better weather the disruption and rebound faster than their peer group. These resiliency leaders experienced on average 10% greater total shareholder return emerging from the disruption accelerating to 50% in year 2 and 3 of the rebound.

Chance or Design? The evidence demonstrates this is by design. This is why we believe that developing comprehensive Stress Test Scenarios and building this discipline into your operations provides multiple benefits, it allows for:

- Faster recovery

- More agility and flexibility

- Greater financial returns

- Development of insights and information to design Resiliency into supply chains

As the McKinsey Report indicates, companies can downplay the potential supply chain disruption, consider these factors in silos, and “hope for the best” when, not if, the next wave of disruptions occur. Or those companies can design for resilience and thrive while their peers struggle.

“Chance favors the prepared mind.” – Louis Pasteur